Gail Vaz-Oxlade, financial writer and author of several financial help books (Money Rules, A Woman of Independent Means and Debt Free Forever, amongst others) and former host of popular TV shows Til Debt Do Us Part, Princess and Money Moron (airing currently on Slice) has been helping Canadians to get out of the financial holes they often find themselves in. She is currently trying to reach all Canadians to teach them personal finance responsibility with the launch of her website My Money, My Choices. Alma Latina had a chance to talk with the passionate and straightforward financial guru to offer our readers her take on what we all must do to be free from the stresses of dealing with money matters.

Photo Courtesy of Debtfreeforever.ca

“Money is a huge stressor,” says Gail. “So when people are worried about money, it interacts with everything: it affects the way they do their job, it affects their relationships at home, it affects how they interact with their kids. Everything just seems to be more heightened emotionally when money is a stressor. In the last few years money has become the number one stressor amongst people– never used to be. There were other things that were more stressful.”

The root of the problem is that we as a society (especially in North America) are deeper and deeper in debt. We have been given an enormous (and in most cases unsustainable) amount of credit and people have used it (and abused it) without thinking how they are going to pay it back. The focus has mainly been on maintaining a minimum payment and not defaulting, and not on paying the full amount back. Debt keeps building up and building up and before you know it, it gets out of control.

Now, all you need is one small change in circumstances, says Gail, for money to go from being just a stressor to being an enormous stressor and even ruling (and ruining) your life: you lose your job, there is a medical emergency– whatever it is, any small change will bring your life into chaos. The sad truth, and what’s really scary, is that most people live paycheque to paycheque, not having any money set aside for emergencies.

The signs that finances are starting to get out of control:

“The biggest thing is if you’re carrying any type of consumer debt at all (debts on credit cards and/or retail store cards and lines of credit), in all likelihood you are spending money you don’t have and that’s the number one sign,” she says. “If you’re trying to figure out which bill to pay, you’re in trouble. Part of the problem is that people’s expectations are now bigger than their wallets. So many of us have bought into the ‘If I don’t have the best car and if I’m not wearing the latest fashion, if I don’t have all the toys everybody else has, then in some way my life is lacking– which stops us from looking at the things that make our life actually worthwhile and now we’re focusing on the stuff, and the stuff never makes us happy.”

What makes Gail’s message so palatable is that she doesn’t sugar-coat the truth: She’ll tell you what is wrong and how to fix it without preambles and sweet words. “Wanting something is a good thing. Don’t get me wrong: ambition is a good thing. It’s wonderful to want to have a home of your own and have a newer car and to want to have your kids in three activities. But if you can’t pay for it, then you can’t have it: it’s that simple. If you’re having it on the back of the future income you hope to earn, you’re really screwed.”

Gail reminds us that when you pay with plastic, you distance yourself from the actual act of spending your money. When you buy with debit cards, for instance (which is really paying with cash), you know the next time you check your back account you will have the amount you just spent deducted. Paying with cash is both gratifying (you get what you want right away) but also painful (you suffer the loss immediately). If you buy with credit cards, there is that 30-day period when you’re almost in denial. You get all the pleasure of spending, but you don’t get any of the pain of having parted with the money. Some people don’t even open their statements, says Gail, deceiving themselves into the idea that if you don’t see it then maybe the debt is not really there. But it is, and you learn that the hard way.

It Doesn’t Matter How Much Money You Make.

It doesn’t matter how much money you make: people spend 5, 10 times what they make. In her show, Gail helped couples who had sometimes over $100,000 to $150,000 of combined income, and had yet managed to rack up five, ten times their salaries in debt, as well as people of more modest means who, through debt, were living way above their means– to their detriment. Once you’re overspending, you’re overspending, no matter how much money you make, and you need to take control of your finances and live within your means, regardless of how good your salary is.

“If you’re overspending, you’re never going to come to a good place,” says Gail. “The only way to have money is to not spend it. And people use the word ‘Save’ to mean different things. Some people use coupons to save, let’s say, 50 cents. And I say to people, ‘Well, show me the 50 cents.’ And they didn’t actually save the 50 cents, but spent them somewhere else. Saving is the act of not spending money.” What you must do is put away the 50 cents you save, and at the end of the month take all that money you actually did save and put it in a savings account. Then you really have saved money.

Budgeting:

“Budgeting and tracking what you’re spending is everything. People say to me all the time, ‘That’s a pain in the ass’, ‘I don’t have time to do that’, ‘I make enough money. It’s not necessary for me to do that.'” But no matter what the excuse, she insists it is very important for you to keep track of how much money you’re spending. I myself thought I was being so clever because I was putting all my bills in a small can and I usually know by the end of the month how much we’ve spent as a family. But Gail showed me that I’m doing the process backwards because I’m only seeing how much I spent and not really controlling where the money goes. I only know how much I’ve spent after the fact.

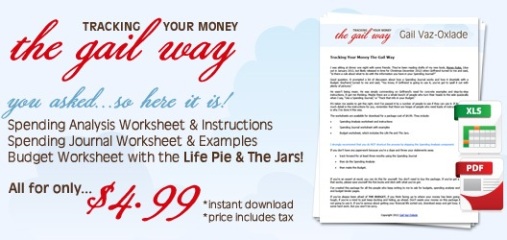

Instead, she recommends to keep track of everything in a Spending Journal. “What you would do,” she says, “is you get a notebook and for example today you put at the top of the first page the balance (the amount of money that you start the day with) in your bank account.” Every time you buy something, you write down the amount in the Spending Journal and you deduct it from what’s in the bank. Then at the end of the month you have your budget, you know what you were going to spend because you have outlined all the money you were planning to spend in all the different categories; you distribute the amounts in the different categories from your Spending Journal and then redistribute what’s left if you spent more in one category than in another one. That way you try to balance your budget. You might even have money left over in some categories for the following month. “It only takes about an hour a month to manage your money and track your spending”, says Gail. This method of managing personal finances is what she calls The Gail Way.

To make it easier for her readers, she has the worksheets and a free interactive budget on her website, but she also has a fee-based ($4.99) program that gives all the information in one place, including a budget already set up. “This is the way I manage my money, the way I do it, that’s why I call it The Gail Way because I am a huge believer of if you’re not watching where the money is going, (then) you don’t know what you’re doing with your money– you think you know ’cause you’re doing mental math, but mental math does not work.”

But don’t fool yourself into thinking this will work for everyone: this method is not for everybody. She had a couple on Til Debt Do Us part where the man was just not willing to make the changes necessary to get back in control of the couple’s finances, arguing that he wanted to live (and spend) now and that he’d have time to save later. Some people are not ready to make the changes, and instead they’re living for instant gratification and thinking they don’t need to be financially responsible. “You can’t reach them,” says Gail. “There’s nothing you can do about that. Those people will do what they’re going to do. The best thing you can do is not get involved with one of them. They’re still not ready and you have to be ready for this,” she says.

Because financial interest is a huge problem in Canada, she says, and because there are people who are willing to try to make a big change in their lives– they just don’t know where to start– Gail created her own website, My Money, My Choices, which is a free-of-cost financial literacy roadmap. It takes you step by step on what to do, starting with a Spending Analysis and followed by making a balanced budget. This road map takes you through 23 levels, with each level having a series of activities to do. “All of them are meant to take you to a place where you have a solid financial foundation. It’s a road map to lead you to wherever it is you are now to where you need to be to have a rock solid financial foundation.”

The idea is to have this as a community-based program, with community members working together (one learns and teaches the method to someone else and so on– in a pay-it-forward manner to get the ball rolling) and helping one another to complete the program. She started it on November 1 (she launched the program in November because this is Financial Literacy month) and already about 1,500 people have signed up to complete the program.

In her customary no-nonsense style, she says that taking control of your own finances is doable and it’s all up to you. There is always a light at the end of the tunnel. “At the crux of the problem for where we are right now is the fact that you can’t say you don’t know ’cause it’s in the books (she’s written extensively about financial matters), you can’t say you don’t know where to start because it’s in the website, My Money My Choices. Everything is laid out. I am spoon-feeding it to you. If you don’t do it, that is not my problem.” Just like we work hard at many other things (jobs, raising our kids, even hobbies), it takes just as much effort to work on how to manage our finances, argues Gail. “Why is it that we think we don’t have to do the work on our money? Everything has some work associated with it. It’s supposed to be some kind of magic? It’s just supposed to happen? Work!” If there is someone out there who is really passionate about money and finances, and who will do (and say) whatever it takes to get you back on a good personal financial standing, it is without a doubt Gail Vaz-Oxlade!